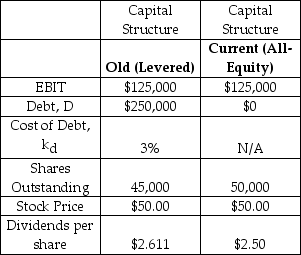

Jungle Cat Petting Zoo Inc.is currently all equity financed.It used to be leveraged,but it recently issued 5,000 new shares at $50 per share.The proceeds from the new issue were used to repay all of its debt.Financial details for the current and old capital structures are presented in the table below.

Assume that Jungle Cat generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons at 3%.Assume that individual investors can borrow and lend at the same interest rate (and with the same terms) as corporations.

Leo Delgato is a shareholder in Jungle Cat who owns 6,750 shares.After the new issue,Leo is unhappy with his dividends.How many shares does Leo have to buy (or sell) in order to return his annual cash flows to the level he enjoyed when the company was leveraged?

A) Buy 750 shares

B) Sell 750 shares

C) Buy 675 shares

D) Sell 675 shares

E) Do nothing. The investment cash flows are identical under each capital structure

Correct Answer:

Verified

Q40: A firm has a projected EBIT of

Q41: Bob's Farm Rental and Party Supply posted

Q42: What is the optimal capital structure?

A) The

Q43: The Mohawk & Hudson Railway (M&H)currently has

Q44: Tarbox Tobacco Inc.is all equity financed and

Q46: The Cripple Creek Railway is currently all

Q47: The Cramden Bus Company is currently all

Q48: Austin-Healey Motors Inc.is currently levered.It used to

Q49: The Pennsylvania Railroad (PRR)currently has a levered

Q50: Which of the following is NOT a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents