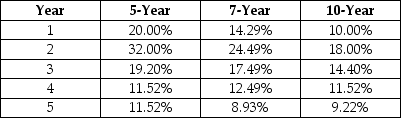

Droids-R-Us Inc.(DRU) ,is considering the installation of a new production line to make service mechanoids.The cost of the new manufacturing equipment is $2.2 million.The machines are classified as 7-year properties.(MACRS rates are provided in the table,below.) The machines will be purchased at the beginning of 2014.(DRU uses a mid-year placed-in-service convention.) DRU's engineers estimate that the new assembly line could be ready for operations in early 2014.Annual EBITDA is forecasted to be $1.3M for 2014 and all subsequent years of the project.DRU's marginal tax rate is 35%.What is the value of the depreciation tax shield in 2015? (Do NOT assume that the equipment is salvaged in 2015.) Round your answers to the nearest dollar.

A) $110,033

B) $188,573

C) $134,673

D) $314,380

E) $538,780

Correct Answer:

Verified

Q4: Using the following data,what is the change

Q5: The book value of an asset is

Q6: Bill Sharpe,owner of Sharper Knives Inc.,is closing

Q7: Jones Crusher Company is evaluating the proposed

Q8: Bill Sharpe,owner of Sharper Knives Inc.,is closing

Q10: A project having the conventional pattern of

Q11: The book value of an asset is

Q12: The sale of an ordinary asset for

Q13: The relevant cash flows for a proposed

Q14: Net working capital is the amount by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents