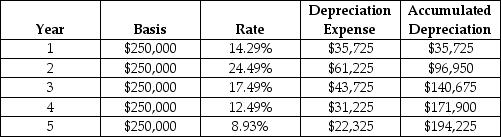

Bill Sharpe,owner of Sharper Knives Inc.,is closing his business at the end of the current fiscal year.His sole asset,the knife-sharpening machine,is three years old.A depreciation table for the asset is shown below.Bill has agreed to sell the machine at the end of the year for $100,000.What is the impact on taxes from the sale of the machine? (Assume that Sharper Knives claimed a regular depreciation expense in the calculation of income taxes.) The tax rate is 35%.Round your answers to the nearest dollar.

Depreciation Table for Knife Sharpener

A) $3,264 tax refund from IRS

B) $3,264 additional taxes owing to IRS

C) $14,236 tax refund from IRS

D) $14,236 additional taxes owing to IRS

E) $38,264 tax refund from IRS

Correct Answer:

Verified

Q3: An outlay for installation costs is not

Q4: Using the following data,what is the change

Q5: The book value of an asset is

Q6: Bill Sharpe,owner of Sharper Knives Inc.,is closing

Q7: Jones Crusher Company is evaluating the proposed

Q9: Droids-R-Us Inc.(DRU),is considering the installation of a

Q10: A project having the conventional pattern of

Q11: The book value of an asset is

Q12: The sale of an ordinary asset for

Q13: The relevant cash flows for a proposed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents