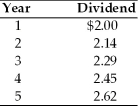

A firm has common stock with a market price of $55 per share and an expected dividend of $2.81 per share at the end of the coming year.The dividends paid on the outstanding stock over the past five years are as follows:  The cost of the firm's common stock equity is ________.

The cost of the firm's common stock equity is ________.

A) 4.1 percent

B) 5.1 percent

C) 12.1 percent

D) 15.4 percent

Correct Answer:

Verified

Q81: The cost of retained earnings is _.

A)

Q84: A firm has common stock with a

Q84: The cost of common stock equity may

Q85: In comparing the constant-growth model and the

Q89: Given that the cost of common stock

Q90: In calculating the cost of common stock

Q91: In calculating the cost of common stock

Q95: A firm has a beta of 1.2.

Q99: One major expense associated with issuing new

Q100: A firm has common stock with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents