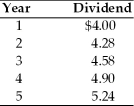

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year.A new issue of stock is expected to be sold for $98,with $2 per share representing the underpricing necessary in the competitive capital market.Flotation costs are expected to total $1 per share.The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is ________.

The cost of this new issue of common stock is ________.

A) 5.8 percent

B) 7.7 percent

C) 10.8 percent

D) 12.8 percent

Correct Answer:

Verified

Q68: According to the CAPM, the required return

Q70: A firm can retain more of its

Q85: In comparing the constant-growth model and the

Q86: The cost of common stock equity is

Q88: A firm has common stock with a

Q89: Given that the cost of common stock

Q90: In calculating the cost of common stock

Q95: A firm has a beta of 1.2.

Q96: The cost of new common stock financing

Q100: A firm has common stock with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents