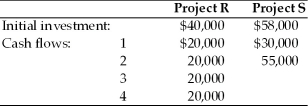

A firm is evaluating two mutually exclusive projects that have unequal lives.The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select.The firm's cost of capital has been determined to be 14 percent,and the projects have the following initial investments and cash flows:

A) Choose Project R because its ANPV is $6459

B) Choose Project S because its ANPV is $6459

C) Choose Project R because its ANPV is $18,274

D) Choose Project S because its ANPV is $10,637

Correct Answer:

Verified

Q96: The option to develop follow-on projects, expand

Q103: If a firm has a limited capital

Q104: An IRR approach to capital rationing involves

Q106: An approach to capital rationing that involves

Q161: Table 11.11

Yong Importers,an Asian import company,is evaluating

Q162: Table 11.11

Yong Importers,an Asian import company,is evaluating

Q163: Table 11.11

Yong Importers,an Asian import company,is evaluating

Q165: Table 11.11

Yong Importers,an Asian import company,is evaluating

Q167: Table 11.11

Yong Importers,an Asian import company,is evaluating

Q202: A firm is evaluating two mutually exclusive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents