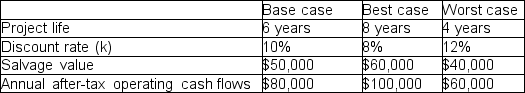

Delta Corporation is considering an investment of $400,000 in a new machine,which belongs to asset class 43 with a CCA rate of 30 percent.The machine is not the only asset in the asset class.The firm's effective tax rate is 40 percent.The company has the following estimates:

A) Determine the NPV for each scenario.

B) Would you recommend the company to undertake the project if each scenario is equally likely? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q114: Suppose a new machine costs $100,000 and

Q116: A firm is considering a project that

Q116: A piece of land outside of Toronto

Q118: Which measure of inflation do you think

Q119: A firm is considering purchasing a new

Q119: Explain the importance of scenario analysis in

Q120: A Bromont ski equipment manufacturer is thinking

Q121: A firm is considering an investment of

Q122: BathGate Group has just completed its analysis

Q123: A firm is considering a project that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents