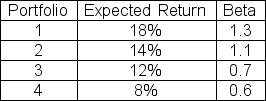

The expected return on the market is 14 percent with a standard deviation of 18 percent and the risk-free rate is 5 percent.Which of the following portfolios are underpriced?

A) 1 and 2 only

B) 1 and 3 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Q93: Stock XYZ has a beta of 1.6

Q94: In the above question,F1 F2, and F3

Q95: Stock Y has a beta of 0.8

Q96: SML-CAPM Question:

Antigone Inc.paid out a dividend of

Q97: Suppose the returns on Security B are

Q99: Which one of the following is NOT

Q100: The expected return on the market is

Q101: Is it possible to invest more than

Q103: Given the following information: Q109: If two stocks had the same beta,

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents