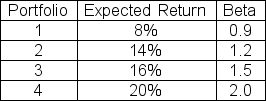

The expected return on the market is 12 percent with a standard deviation of 20 percent and the risk-free rate is 4 percent.Which of the following portfolios are correctly priced?

A) 1 and 2 only

B) 1 and 4 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Q95: Stock Y has a beta of 0.8

Q96: SML-CAPM Question:

Antigone Inc.paid out a dividend of

Q97: Suppose the returns on Security B are

Q98: The expected return on the market is

Q99: Which one of the following is NOT

Q101: Is it possible to invest more than

Q103: Given the following information: Q104: "There may be some truth in the Q105: You have two portfolios,A and B.Portfolio A Q109: If two stocks had the same beta,

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents