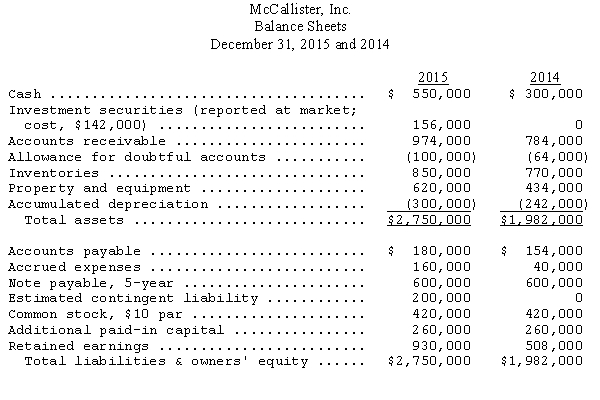

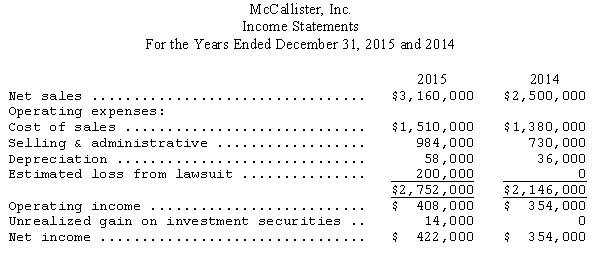

McCallister,Inc.,a nonpublic enterprise,is negotiating a loan for expansion purposes and the bank requires audited financial statements.Before closing the accounting records for the year ended December 31,2015,McCallister' controller prepared the following comparative financial statements for 2015 and 2014:

During the audit,the following additional information was obtained:

(a)The investment portfolio consists of investments in trading securities with a total market value of $156,000 at December 31,2015.The securities were purchased February 3,2015,at a cost of $142,000.

(b)As a result of errors in physical count,inventories were overstated by $30,000 at December 31,2015.

(c)On January 2,2015,the cost of equipment purchased for $80,000 was mistakenly charged to repairs and maintenance.McCallister depreciates this type of equipment over a 5-year life using the straight-line method,with no residual or salvage value.

(d)McCallister was named as a defendant in a lawsuit in October 2015.McCallister' counsel is of the opinion that McCallister has a good defense and does not anticipate any impairment of McCallister' assets or that any significant liability will be incurred.However,McCallister' counsel admits that loss of the suit is "possible." McCallister' management wished to be conservative and established a loss contingency of $200,000 at December 31,2015.

(e)On January 24,2016,before the 2015 financial statements were issued,McCallister was notified that one of its largest customers had filed for bankruptcy as the result of a flood that destroyed a substantial portion of the company's assets on January 16,2016.The customer's accounts receivable balance at December 31,2015,was $144,000.

(f)$100,000 of 5-year notes payable will mature September 30,2016.In view of McCallister' plans for expansion,management is seriously considering refinancing the notes when they become due.

(1)Prepare a properly classified balance sheet for McCallister,Inc.,as of December 31,2015.(Income tax considerations should be ignored.)(2)Identify the events and other information that should be disclosed in the notes to McCallister' financial statements.(Do not prepare the notes.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: In relation to a set of 2015

Q58: The following information is provided for Rodriguez

Q60: Southeast Company's adjusted trial balance at December

Q60: Which of the following is not true

Q61: The following totals are taken from the

Q63: Heartland Company reported liabilities totaling $1,230,000 as

Q64: Bowman Company reported assets totaling $870,000 as

Q65: Knowledgeable users of financial statements recognize that

Q66: Certain assets currently are omitted from the

Q67: The following totals are taken from the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents