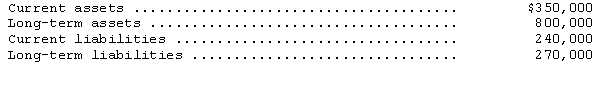

The following totals are taken from the December 31,2015,balance sheet of Mentor Company:

Additional information:

(a)Cash of $38,000 has been placed in a fund for the retirement of long-term debt.The cash and long-term debt have been offset and are not reflected in the financial statements.

(b)Long-term assets include $50,000 in treasury stock.

(c)Cash of $14,000 has been set aside to pay taxes due.The cash and taxes payable have been offset and do not appear in the financial statements.

(d)Advances on salespersons' commissions in the amount of $21,000 have been made.Also,sales commissions payable total $24,000.The net liability of $3,000 is included in Current Liabilities.

After making any necessary changes,what are the totals for Mentor's current assets and current liabilities?

Correct Answer:

Verified

Q46: In relation to a set of 2015

Q51: Which of the following is an appropriate

Q58: The following information is provided for Rodriguez

Q60: Southeast Company's adjusted trial balance at December

Q60: Which of the following is not true

Q62: McCallister,Inc.,a nonpublic enterprise,is negotiating a loan for

Q63: Heartland Company reported liabilities totaling $1,230,000 as

Q64: Bowman Company reported assets totaling $870,000 as

Q65: Knowledgeable users of financial statements recognize that

Q66: Certain assets currently are omitted from the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents