The 2014 annual report of Arrowhead Manufacturing Company contained the following notes to the company's financial statements:

Inventory Valuation

The company uses the last-in,first-out (LIFO)cost method of inventory valuation for most domestic manufacturing inventories.Other manufacturing inventories are valued at the lower of standard costs (which approximate average costs),average costs,or market.

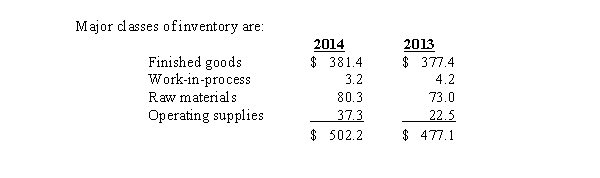

Inventories

If inventories valued on the LIFO basis had been valued at standard or average costs,which approximate current costs,consolidated inventories would be higher than reported by $21.0 million and $19.6 million at December 31,2014,and 2013,respectively.

Inventories that are valued at the lower of standard costs (which approximate average costs),average costs,or market at December 31,2014 and 2013,were approximately $185.2 million and $125.7 million,respectively.

Required:

1.Why does Arrowhead use LIFO only for domestic inventories?

2.What would have been the effect on the Arrowhead 2014 net income if the company had consistently used standard or average costs to value its inventories over time (assume a 34% tax rate)?

3.What would be the effect on retained earnings as of December 31,2014,if Arrowhead had consistently used standard or averages to value its inventories over time?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: The following data are available for Lion's

Q124: The following note appeared in the 2014

Q125: The following data are available for the

Q126: The Cleft Music Company was formed on

Q127: The following is information from the books

Q129: Athletes Sporting Goods began operations February 1,2014.Athletes

Q130: Management of the Singer Company is currently

Q131: The data below relate to Raw Material

Q132: The claim is sometimes made that the

Q133: Two reasons often advanced for the adoption

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents