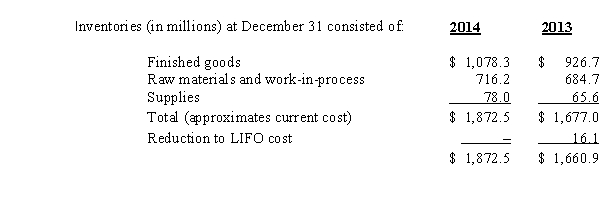

The following note appeared in the 2014 annual report of Edison Company:

Inventories

Inventories valued at LIFO comprised approximately 44% and 42% of inventories at December 31,2014 and 2013,respectively.

Required:

1.What basis do you believe Edison uses to account for its inventories internally?

2.Express your opinion as to why Edison reduces its inventories to LIFO cost.

3.If Edison did not adjust its inventories to LIFO cost,what would be the impact on Edison's

a.Net income before tax for 2013?

b.Retained earnings as of January 1,2014 (assuming a 34% tax rate)? Edison's reduction to LIFO cost in 2014 was $19.1 million.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: Kendall Company reported the following net income

Q120: The inventory write-down rule under IAS 2

Q121: The skeleton of the basic retail inventory

Q122: The following information was available from the

Q123: The following data are available for Lion's

Q125: The following data are available for the

Q126: The Cleft Music Company was formed on

Q127: The following is information from the books

Q128: The 2014 annual report of Arrowhead Manufacturing

Q129: Athletes Sporting Goods began operations February 1,2014.Athletes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents