The price of a bond issue is determined by the market or effective rate of interest.A bond issue with a 8% stated interest rate will sell for less than face value if the market or effective rate of interest is 10%.The creditworthiness of the issuing entity is one of the factors that influence the market rate for a specific bond issue.Investors rely heavily on bond ratings provided by Standard & Poor's Corporation and by Moody's Investors Service,Inc.Required:

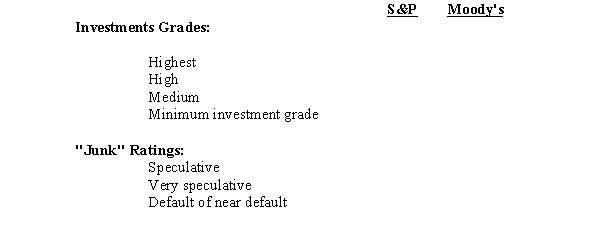

Complete the table below by entering the appropriate rating for each level of risk under the S&P and Moody's rating systems.

Correct Answer:

Verified

Q101: Listed below are the current liability section

Q102: The globalization of business has caused many

Q103: Assume R Company has one asset,a V

Q104: Much of the dissatisfaction about Enron's accounting

Q105: Debt securities frequently are issued with a

Q106: Footnote disclosures for long-term liabilities provide information

Q107: A portion of the long-term liability footnote

Q108: The Financial Accounting Standards Board issued Statement

Q109: On March 1,2014,Wunder Furniture Co.issued $950,000 of

Q110: On December 31,2013,National Refining Company purchased machinery

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents