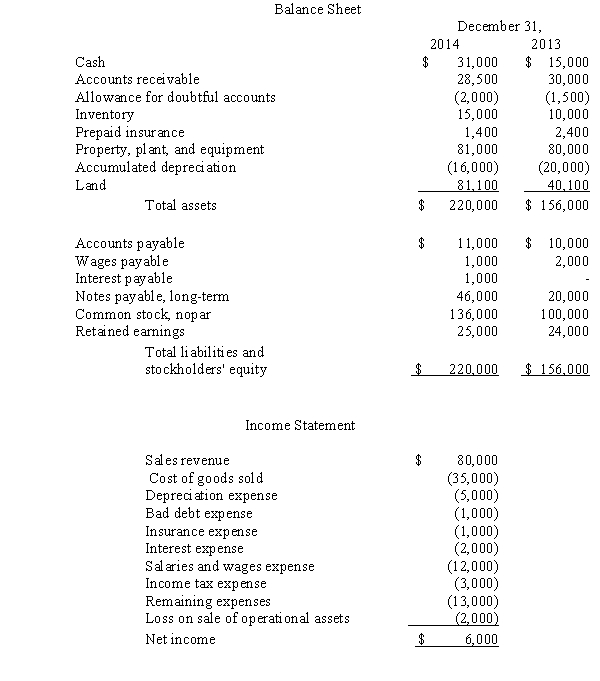

Financial information for Princeton Company at December 31,2014,and for the year then ended,are presented below:

Additional information:

1.Wrote off $500 accounts receivable as uncollectible.

2.Sold an operational asset for $4,000 cash (cost,$15,000,accumulated depreciation,$9,000).

3.Issued common stock for $5,000 cash.

4.Declared and paid a cash dividend of $5,000.

5.Purchased land for $20,000 cash.

6.Acquired land for $21,000,and issued common stock as payment in full.

7.Acquired operational assets,cost $16,000; issued a $16,000,three-year,interest-bearing note payable.

8.Paid a $10,000 long-term note installment by issuing common stock to the creditor.

9.Borrowed cash on a long-term note,$20,000.

Required:

Prepare the statement of cash flows using the indirect method.

Correct Answer:

Verified

Q56: If a company issues both a balance

Q57: At the beginning of the year,a firm

Q59: A firm's accumulated depreciation account increased $30,000

Q61: Financial information for Inverness Company at December

Q62: The following information for Connor Company is

Q63: The following is Grafton Corporation's comparative balance

Q64: The records of Bramhall Company provided the

Q65: Show the U.S.Approach and the U.K.Approach to

Q66: The following information for Amphora Company is

Q67: Use the following information to compute the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents