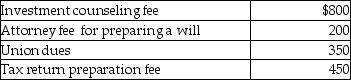

Daniel had adjusted gross income of $60,000,which consisted of $55,000 in wages and $5,000 in dividend income from taxable domestic corporations.His expenses include:  What is the net amount deductible by Daniel for the above items?

What is the net amount deductible by Daniel for the above items?

A) $400

B) $600

C) $1,000

D) $1,600

Correct Answer:

Verified

Q83: Carol contributes a painting to a local

Q89: During 2013 Richard and Denisa,who are married

Q90: During the current year,Deborah Baronne,a single individual,paid

Q93: Grace has AGI of $60,000 in 2012

Q95: Hope is a marketing manager at a

Q99: Wang,a licensed architect employed by Skye Architects,incurred

Q116: Patrick's records for the current year contain

Q266: Explain under what circumstances meals and lodging

Q280: Explain when the cost of living in

Q284: Discuss what circumstances must be met for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents