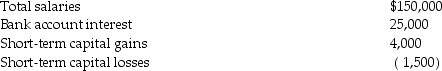

During 2013 Richard and Denisa,who are married and have two dependent children,have the following income and losses:

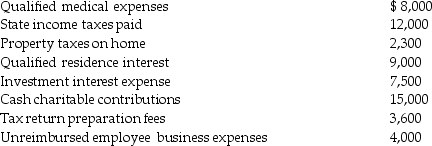

They also incurred the following expenses:

They also incurred the following expenses:

Compute Richard and Denisa's taxable income for the year.(Show all calculations in good form.)

Compute Richard and Denisa's taxable income for the year.(Show all calculations in good form.)

Correct Answer:

Verified

Itemized deductions:

I...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: On December 1,2012,Delilah borrows $2,000 from her

Q88: Phoebe's AGI for the current year is

Q90: During the current year,Deborah Baronne,a single individual,paid

Q93: Grace has AGI of $60,000 in 2012

Q94: Daniel had adjusted gross income of $60,000,which

Q109: Which of the following is not required

Q116: Patrick's records for the current year contain

Q270: Discuss the timing of the allowable medical

Q280: Explain when the cost of living in

Q335: Explain why interest expense on investments is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents