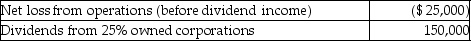

Jenkins Corporation has the following income and expense items during the current year:  The allowed dividends-received deduction is

The allowed dividends-received deduction is

A) $100,000.

B) $120,000.

C) $125,000.

D) $150,000.

Correct Answer:

Verified

Q8: All of the following are accurate statements

Q21: Identify which of the following statements is

Q37: If a corporation's charitable contributions exceed the

Q47: June Corporation has the following income and

Q50: A corporation redeems 10 percent of the

Q50: With respect to charitable contributions by corporations,

Q53: For this tax year,Madison Corporation had taxable

Q55: Louisiana Land Corporation reported the following results

Q105: Dividends paid from E&P are taxable to

Q113: A shareholder receives a distribution from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents