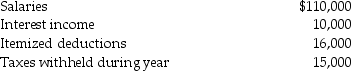

Brad and Angie had the following income and deductions during 2014:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Larry and Ally are married and file

Q85: Describe the steps in the legislative process

Q90: Frederick failed to file his 2014 tax

Q91: Vincent makes the following gifts during 2014:

$15,000

Q92: What are the correct monthly rates for

Q95: Jeffery died in 2014 leaving a $16,000,000

Q96: Latashia reports $100,000 of gross income on

Q2194: A presidential candidate proposes replacing the income

Q2216: During the current tax year, Frank Corporation

Q2220: Doug and Frank form a partnership, D

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents