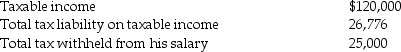

Frederick failed to file his 2014 tax return on a timely basis.In fact,he filed his 2014 income tax return on October 31,2015,(the due date was April 15,2015)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2014 return:

Frederick sent a check for $1,776 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2014.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,776 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2014.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Larry and Ally are married and file

Q78: During the current tax year,Charlie Corporation generated

Q86: Mia is self-employed as a consultant.During 2013,Mia

Q91: Vincent makes the following gifts during 2014:

$15,000

Q92: What are the correct monthly rates for

Q93: Brad and Angie had the following income

Q94: Which is not a component of tax

Q95: Jeffery died in 2014 leaving a $16,000,000

Q2194: A presidential candidate proposes replacing the income

Q2216: During the current tax year, Frank Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents