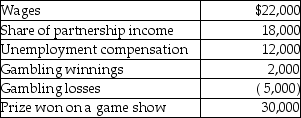

Lori had the following income and losses during the current year:  What is Lori's adjusted gross income (not taxable income) ?

What is Lori's adjusted gross income (not taxable income) ?

A) $72,000

B) $79,000

C) $82,000

D) $84,000

Correct Answer:

Verified

Q81: Julia,age 57,purchases an annuity for $33,600.Julia will

Q85: Carolyn,who earns $400,000,is required to pay John,her

Q100: Thomas purchased an annuity for $20,000 that

Q102: As a result of a divorce,Michael pays

Q102: Mr.& Mrs.Bronson are both over 65 years

Q104: In addition to Social Security benefits of

Q104: Reva is a single taxpayer with a

Q105: While using a metal detector at the

Q112: Jan purchased an antique desk at auction.For

Q884: Rocky owns The Palms Apartments. During the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents