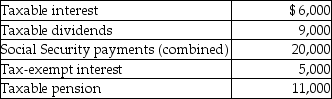

Mr.& Mrs.Bronson are both over 65 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

A) $0

B) $4,500

C) $10,000

D) $20,000

Correct Answer:

Verified

Q48: Chance Corporation began operating a new retail

Q98: Lori had the following income and losses

Q102: As a result of a divorce,Michael pays

Q104: In addition to Social Security benefits of

Q104: Reva is a single taxpayer with a

Q104: Ellen is a single taxpayer with qualified

Q107: On January 1,1996,Erika Greene purchased a single

Q112: Jan purchased an antique desk at auction.For

Q117: Insurance proceeds received because of the destruction

Q884: Rocky owns The Palms Apartments. During the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents