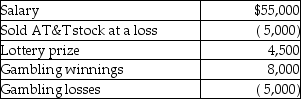

A taxpayer had the following income and losses in the current year:  What is the taxpayer's adjusted gross income (not taxable income) ?

What is the taxpayer's adjusted gross income (not taxable income) ?

A) $57,500

B) $59,500

C) $62,500

D) $64,500

Correct Answer:

Verified

Q81: Julia,age 57,purchases an annuity for $33,600.Julia will

Q82: Under the terms of their divorce agreement,Humphrey

Q88: Reva is a single taxpayer with a

Q88: David,age 62,retires and receives $1,000 per month

Q91: Natasha,age 58,purchases an annuity for $40,000.Natasha will

Q96: The term "Social Security benefits" does not

Q100: Lily had the following income and losses

Q101: The Cable TV Company,an accrual basis taxpayer,allows

Q105: While using a metal detector at the

Q884: Rocky owns The Palms Apartments. During the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents