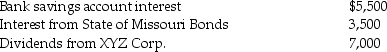

Kevin is a single person who earns $70,000 in salary for 2013 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2012 tax returns in April of 2013.His federal refund was $600 and his state refund was $300.Kevin's 2012 federal itemized deductions totaled $13,000.In 2013 his itemized deductions total only $3,700,and the amount of withholding for Federal income taxes is $16,900.

Kevin received tax refunds when he filed his 2012 tax returns in April of 2013.His federal refund was $600 and his state refund was $300.Kevin's 2012 federal itemized deductions totaled $13,000.In 2013 his itemized deductions total only $3,700,and the amount of withholding for Federal income taxes is $16,900.

Compute Kevin's taxable income for 2013.

Correct Answer:

Verified

Q101: The Cable TV Company,an accrual basis taxpayer,allows

Q103: During 2013,Christiana's employer withheld $1,500 from her

Q104: On April 1,2013,Martha,age 67,begins receiving payments of

Q107: Homer Corporation's office building was destroyed by

Q108: Leigh inherited $65,000 of City of New

Q112: Ellen is a single taxpayer with qualified

Q114: Chuck Corporation began operating a new retail

Q117: Under the terms of a divorce agreement

Q127: Gwen's marginal tax bracket is 25%.Gwen pays

Q884: Rocky owns The Palms Apartments. During the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents