Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year.After gains and losses are offset,Gertie reports

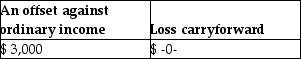

A)

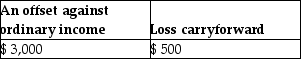

B)

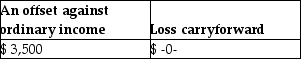

C)

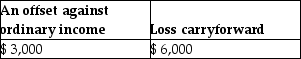

D)

Correct Answer:

Verified

Q78: Gina owns 100 shares of XYZ common

Q85: Antonio is single and has taxable income

Q94: Renee is single and has taxable income

Q97: Nate sold two securities in 2013:

Q98: Stella has two transactions involving the sale

Q100: To be considered a Section 1202 gain,the

Q102: Olivia,a single taxpayer,has AGI of $280,000 which

Q102: Joy purchased 200 shares of HiLo Mutual

Q107: On January 31 of the current year,Sophia

Q124: Everest Inc.is a corporation in the 35%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents