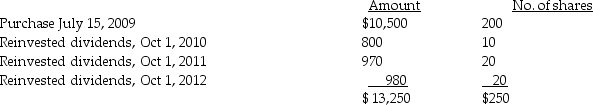

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2009,for $10,500,and has been reinvesting dividends.On December 15,2013,she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: Gina owns 100 shares of XYZ common

Q94: Renee is single and has taxable income

Q97: Nate sold two securities in 2013:

Q99: Gertie has a NSTCL of $9,000 and

Q100: To be considered a Section 1202 gain,the

Q102: Margaret died on September 16,2013,when she owned

Q107: On January 31 of the current year,Sophia

Q107: Tina,whose marginal tax rate is 33%,has the

Q116: On July 25,2012,Karen gives stock with a

Q124: Everest Inc.is a corporation in the 35%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents