Rob sells stock with a cost of $3,000 to his daughter for $2,200,which is its fair market value.Later the daughter sells the stock for $3,200 to an unrelated party.Which of the following describes the tax treatment to Rob and Daughter?

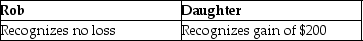

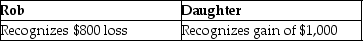

A)

B)

C)

D)

Correct Answer:

Verified

Q84: Which of the following individuals is not

Q88: Kyle drives a race car in his

Q89: Abby owns a condominium in the Great

Q95: Bart operates a sole proprietorship for which

Q97: Victor,a calendar-year taxpayer,owns 100 shares of AB

Q97: For the years 2009 through 2013 (inclusive)Mary,a

Q99: For the years 2009 through 2013 (inclusive)Max,a

Q106: Dana purchased an asset from her brother

Q114: Erin,Sarah,and Timmy are equal partners in EST

Q128: Vanessa owns a houseboat on Lake Las

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents