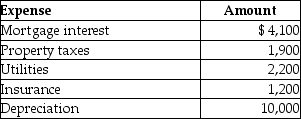

Abby owns a condominium in the Great Smokey Mountains.During the year,Abby uses the condo a total of 21 days.The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500.Abby incurs the following expenses:  Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

A) $ 5,074.

B) $ 8,515.

C) $ 7,900.

D) $10,000.

Correct Answer:

Verified

Q84: Which of the following individuals is not

Q87: Rob sells stock with a cost of

Q88: Kyle drives a race car in his

Q95: Bart operates a sole proprietorship for which

Q97: Victor,a calendar-year taxpayer,owns 100 shares of AB

Q97: For the years 2009 through 2013 (inclusive)Mary,a

Q106: Dana purchased an asset from her brother

Q114: Erin,Sarah,and Timmy are equal partners in EST

Q115: Jason sells stock with an adjusted basis

Q118: Which of the following factors is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents