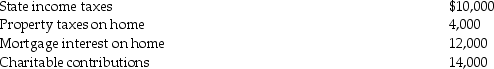

Tasneem,a single taxpayer has paid the following amounts this year:  Tasneem's AGI is $360,000.What is her net itemized deduction allowed?

Tasneem's AGI is $360,000.What is her net itemized deduction allowed?

A) $40,000

B) $38,200

C) $36,700

D) None of the above.

Correct Answer:

Verified

Q86: On December 1,2012,Delilah borrows $2,000 from her

Q93: Grace has AGI of $60,000 in 2012

Q93: Hope is a marketing manager at a

Q96: Wang,a licensed architect employed by Skye Architects,incurred

Q100: Phoebe's AGI for the current year is

Q109: Which of the following is not required

Q266: Explain under what circumstances meals and lodging

Q280: Explain when the cost of living in

Q330: When are points paid on a loan

Q335: Explain why interest expense on investments is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents