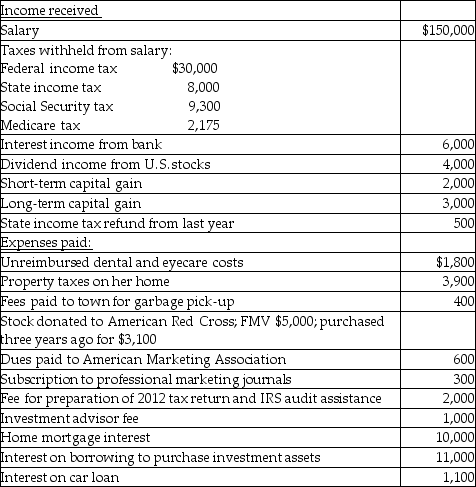

Hope is a marketing manager at a local company.Information about her 2013 income and expenses is as follows:

Compute Hope's taxable income for the year in good form.Show all supporting computations.Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense.Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form.Show all supporting computations.Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense.Also assume that her tax profile was similar in the preceding year.

Correct Answer:

Verified

Q86: On December 1,2012,Delilah borrows $2,000 from her

Q88: Daniel had adjusted gross income of $60,000,which

Q89: During the current year,Deborah Baronne,a single individual,paid

Q93: Grace has AGI of $60,000 in 2012

Q95: Tasneem,a single taxpayer has paid the following

Q96: Wang,a licensed architect employed by Skye Architects,incurred

Q109: Which of the following is not required

Q280: Explain when the cost of living in

Q330: When are points paid on a loan

Q335: Explain why interest expense on investments is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents