Joey and Bob each have 50% interest in a Partnership.Both Joey and the partnership file returns on a calendar year basis.Partnership Q had a $12,000 loss in 2013.Joey's adjusted basis in his partnership interest on January 1,2013 was $5,000.In 2014,the partnership had a profit of $10,000.Assuming there were no other adjustments to Joey's basis in the partnership,what amount of partnership income (loss) should Joey show on his 2013 and 2014 individual income tax returns?

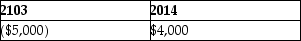

A)

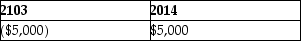

B)

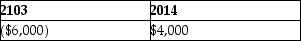

C)

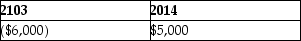

D)

Correct Answer:

Verified

Q61: In the syndication of a partnership,brokerage and

Q63: All of the following are separately stated

Q64: Clark and Lois formed an equal partnership

Q66: Ariel receives from her partnership a nonliquidating

Q67: Martha transferred property with a FMV of

Q73: At the beginning of this year, Edmond

Q74: David and Joycelyn form an equal partnership

Q75: George transferred land having a $170,000 FMV

Q76: Richard has a 50% interest in a

Q76: Sandy and Larry each have a 50%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents