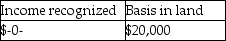

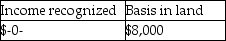

Ariel receives from her partnership a nonliquidating distribution of $9,000 cash plus a parcel of land.The partnership had purchased the land five years ago for $20,000,but it is worth $28,000 at the time of the distribution.Ariel's predistribution basis is $17,000.How much income will Ariel recognize due to the distribution,and what is her basis in the land?

A)

B)

C)

D)

Correct Answer:

Verified

Q61: Atiqa receives a nonliquidating distribution of land

Q62: Atiqa receives a nonliquidating distribution of land

Q63: All of the following are separately stated

Q67: All of the following statements are true

Q67: Martha transferred property with a FMV of

Q71: Joey and Bob each have 50% interest

Q74: David and Joycelyn form an equal partnership

Q76: Richard has a 50% interest in a

Q77: Thomas and Miles are equal partners in

Q78: All of the following statements are true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents