Atiqa receives a nonliquidating distribution of land from her partnership.The partnership purchased the land five years ago for $20,000.At the time of the distribution,it is worth $28,000.Prior to the distribution,Atiqa's basis in her partnership interest is $37,000.Due to the distribution Atiqa and the partnership will recognize income of

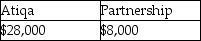

A)

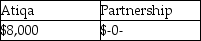

B)

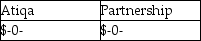

C)

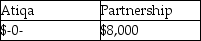

D)

Correct Answer:

Verified

Q14: Limited liability of partners or members is

Q42: Chen contributes a building worth $160,000 (adjusted

Q54: Lance transferred land having a $180,000 FMV

Q57: Edith contributes land having $100,000 FMV and

Q58: Emma contributes property having a $24,000 FMV

Q62: Atiqa receives a nonliquidating distribution of land

Q66: Ariel receives from her partnership a nonliquidating

Q67: All of the following statements are true

Q77: Thomas and Miles are equal partners in

Q78: All of the following statements are true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents