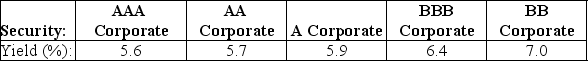

A mining company needs to raise $100 million in order to begin open pit mining of a coal seam.The company will fund this by issuing 30-year bonds with a face value of $1000 and a coupon rating of 6%,paid annually.The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings.If the mining company's bonds receive a A rating,what will be their selling price?

A mining company needs to raise $100 million in order to begin open pit mining of a coal seam.The company will fund this by issuing 30-year bonds with a face value of $1000 and a coupon rating of 6%,paid annually.The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings.If the mining company's bonds receive a A rating,what will be their selling price?

A) $947.22

B) $967.64

C) $1013.91

D) $1016.41

E) $875.91

Correct Answer:

Verified

Q95: The credit spread of a bond shrinks

Q96: A bond has a $1000 face value,ten

Q97: A company issues a ten-year $1000 bond

Q98: A ten-year,zero-coupon bond with a yield to

Q100: Which of the following best describes a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents