Multiple Choice

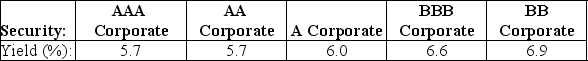

Lloyd Industries raised $28 million in order to upgrade its roller kiln furnace for the production of ceramic tile.The company funded this by issuing 15-year bonds with a face value of $1000 and a coupon rating of 6.2%,paid annually.The above table shows the yield to maturity for similar 15-year corporate bonds of different ratings issued at the same time.When Lloyd Industries issued their bonds,they received a price of $962.63.Which of the following is most likely to be the rating these bonds received?

Lloyd Industries raised $28 million in order to upgrade its roller kiln furnace for the production of ceramic tile.The company funded this by issuing 15-year bonds with a face value of $1000 and a coupon rating of 6.2%,paid annually.The above table shows the yield to maturity for similar 15-year corporate bonds of different ratings issued at the same time.When Lloyd Industries issued their bonds,they received a price of $962.63.Which of the following is most likely to be the rating these bonds received?

A) AA

B) A

C) BBB

D) BB

E) AAA

Correct Answer:

Verified

Related Questions