Use the table for the question(s) below.

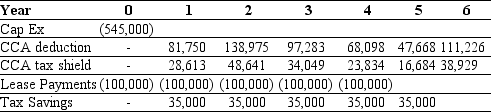

Danby Construction is considering leasing a new crane for the next 5 years.Danby has created the following table of cash flows to help with the decision:

-Danby Construction has decided to lease a new crane for the next 5 years.The purchase price of the crane is $545,000,and the working life of the crane is 10 years.The crane falls under asset class 43 and has a capital cost allowance (CCA) rate of 30%.Assume disposal for $0 at the beginning of year 6.If leased,the annual lease payments will be $80,000 per year for five years,and it is a true tax lease.Assume the tax savings occur at the end of each year.If Danby's borrowing cost is 9%,and its tax rate is 30%,what is the amount of the lease-equivalent loan for the crane?

A) $308,968

B) $175,382

C) -$363,441

D) $156,032

E) $289,618

Correct Answer:

Verified

Q26: Use the information for the question(s) below.

St.

Q32: Use the information for the question(s)below.

St.Martin's Hospital

Q65: Which of the following is a valid

Q66: Should St.Martin lease the scanner or borrow

Q67: What is the amount of the lease-equivalent

Q68: Which of the following is a suspect

Q72: One of the main benefits of leasing

Q73: Is St.Martin's better off leasing the CT

Q74: What is a lease-equivalent loan?

Q75: Use the table for the question(s)below.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents