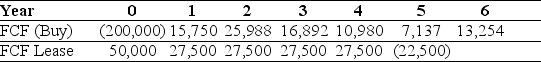

Use the table for the question(s) below.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

-If your firm's borrowing cost is 3% and the tax rate is 45%,what is the NPV of buying and leasing?

A) $20,479

B) $15,069

C) -$20,479

D) -$15,069

E) -$14,145

Correct Answer:

Verified

Q32: Use the information for the question(s)below.

St.Martin's Hospital

Q70: Use the table for the question(s)below.

Danby Construction

Q72: One of the main benefits of leasing

Q73: Is St.Martin's better off leasing the CT

Q74: What is a lease-equivalent loan?

Q76: Which of the following is a valid

Q77: Generally speaking,if the asset's CCA deductions are

Q78: Which of the following is a valid

Q79: Which of the following is a suspect

Q80: Which of the following is a valid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents