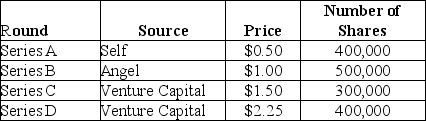

Use the table for the question(s) below.

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

-An IPO is offered at $9.50 per share for 7 million shares.The IPO underwriters had a spread of 7.25%.What price did the underwriters pay per share of the IPO firm?

A) $9.17

B) $8.86

C) $10.19

D) $9.50

E) $8.81

Correct Answer:

Verified

Q38: The firm commitment process is the most

Q39: The main advantages for a firm in

Q40: After the venture capitalist's investment,what percentage of

Q41: Use the table for the question(s)below.

David founds

Q42: An IPO in which the underwriter purchases

Q44: Use the table for the question(s)below.

David founds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents