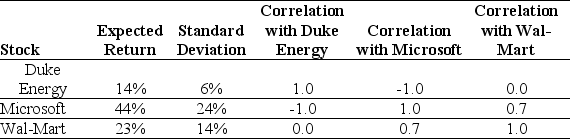

Use the table for the question(s) below.

Consider the following expected returns,volatilities,and correlations:

-The expected return of a portfolio that consists of a long position of $10,000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

A) 21%

B) 12%

C) 27%

D) 18%

E) 24%

Correct Answer:

Verified

Q41: Use the table for the question(s) below.

Consider

Q52: Use the table for the question(s)below.

Consider the

Q53: Use the table for the question(s)below.

Consider the

Q55: Use the table for the question(s)below.

Consider the

Q56: Stocks that have a higher volatility will

Q56: If you build a large enough portfolio,

Q58: A stock market comprises 2000 shares of

Q59: Use the table for the question(s)below.

Consider the

Q61: Air Canada stock has a standard deviation

Q62: You observe the following scatterplot of Ford's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents