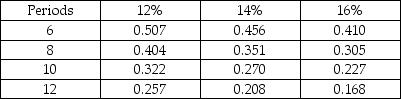

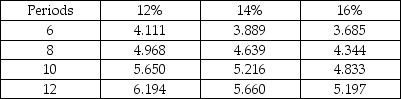

Byer, a plastics processor, is considering the purchase of a high-speed extruder as one option. The new extruder would cost $47,000 and would have a residual value of $5000 at the end of its 6-year life. The annual operating expenses of the new extruder would be $4000. The other option that Byer has is to rebuild its existing extruder. The rebuilding would require an investment of $40,000 and would extend the life of the existing extruder by 6 years. The existing extruder has annual operating costs of $11,000 per year and does not have a residual value. Byer's discount rate is 12%. Using net present value analysis, which option is the better option and by how much? Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

A) Better by $21,777 to rebuild existing extruder

B) Better by $21,777 to purchase new extruder

C) Better by $24,312 to rebuild existing extruder

D) Better by $24,312 to purchase new extruder

Correct Answer:

Verified

Q140: When evaluating the cash flows from an

Q141: Reece Corporation is considering the purchase of

Q142: A company finds that the residual value

Q143: Karpets Industries is investing in a new

Q144: Ryker Manufacturing is evaluating investing in a

Q146: The Speedy-Delivery Company has two options for

Q147: The profitability index is also known as

A)future

Q148: Coyne Corporation is evaluating a capital investment

Q149: A company would consider all of the

Q150: Glassworks Inc. is considering the purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents