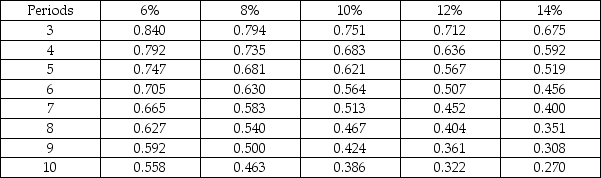

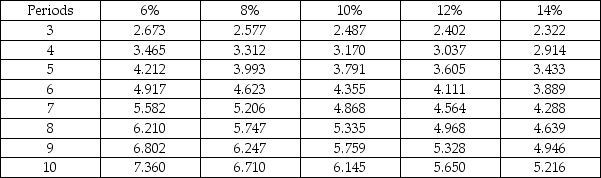

Glassworks Inc. is considering the purchase of a special blow-molding machine that would cost $59,752 and would have a useful life of 8 years. The machine would generate $11,200 of net annual cash inflows per year for each of the 8 years of its life. The internal rate of return on the machine would be closest to: Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

A) 8%.

B) 10%.

C) 12%.

D) 14%.

Correct Answer:

Verified

Q145: Byer, a plastics processor, is considering the

Q146: The Speedy-Delivery Company has two options for

Q147: The profitability index is also known as

A)future

Q148: Coyne Corporation is evaluating a capital investment

Q149: A company would consider all of the

Q151: Justice Enterprises is evaluating the purchase of

Q152: Westin Manufacturing is considering the purchase of

Q153: Another name for the minimum desired rate

Q154: Mystic Metal Stamping is analyzing a special

Q155: Interior Products, Inc. is evaluating the purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents