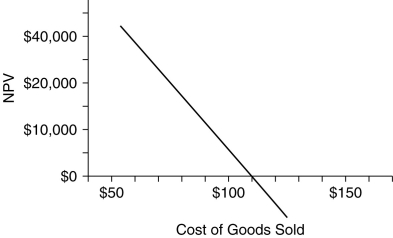

Use the figure for the question(s) below.

-A maker of kitchenware is planning on selling a new chef-quality kitchen knife. The manufacturer expects to sell 1.6 million knives at a price of $120 each. These knives cost $80 each to produce. Selling, general, and administrative (SG&A) expenses are $500 000. The machinery required to produce the knives cost $1.4 million, depreciated by straight-line depreciation over five years. The maker determines that the EBIT break-even point for units sold and sale price is less than these estimates and that the EBIT break-even point for costs per unit, SG&A, and depreciation are greater than these estimates, so decides to go ahead with manufacturing the knife. Was this the correct decision?

A) Yes, since a positive EBIT ensures that the project will have a positive net present value (NPV) .

B) No, since the cost per unit should be greater than the EBIT break-even point for cost of goods if the project is to have a positive EBIT.

C) Yes, since if the estimates for each parameter are correct, the EBIT will be positive.

D) It cannot be determined whether the decision was correct, since other factors contributing to the project's net present value (NPV) , such as the upfront investment, have not been included in the analysis.

Correct Answer:

Verified

Q69: Use the figure for the question(s)below.

Q70: A company planning to market a new

Q71: A company spends $20 million researching whether

Q72: An insurance office owns a large building.

Q73: What is 'break-even analysis'?

Q76: Which of the following best explains why

Q77: Use the table for the question(s)below.

Q78: Use the table for the question(s)below.

Q82: The most difficult part of the capital

Q89: Use the figure for the question(s) below.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents