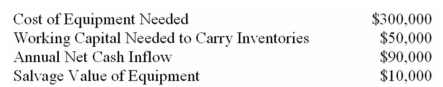

(Appendix 13A and 13B)Vernal Company has been offered a seven-year contract to supply a part for the military.After careful study,the company has developed the following estimated data relating to the contract:

The equipment above would be in Class 7 with a 15% CCA rate.The company would take the maximum CCA allowable each year.It is not expected that the contract would be extended beyond the initial contract period.The company's after-tax cost of capital is 10%,and the tax rate is 30%.

Required:

Use net present value analysis to determine whether or not the contract should be accepted.(Round all calculations to the nearest dollar. )

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q171: (Appendix 13A and 13B)Roy Company is trying

Q173: (Appendix 13A)Vernon Company has been offered a

Q174: AB Company is considering the purchase

Q175: (Appendix 13A)General Manufacturing Company consists of several

Q175: To determine the effect of income

Q176: (Appendix 13A)Bradley Company's required rate of return

Q177: (Appendix 13A)Monson Company is considering three investment

Q177: If a firm acquires a depreciable

Q178: (Appendix 13A)Ursus,Inc.is considering a project that would

Q182: Suppose that your company has ample

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents