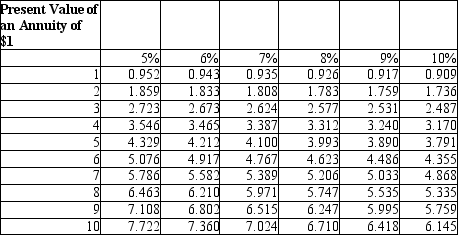

Beta Company is considering an investment in a new storage facility that would require an initial outlay of $250,000, and would yield yearly cash flows of $48,000 for 8 years. Beta uses a discount rate of 7% What is the NPV of the investment?

A) $36,608

B) $24,177

C) $13,184

D) $44,000

Correct Answer:

Verified

Q122: Please refer to the following data concerning

Q123: Harvard Investments is considering an opportunity which

Q123: Under conditions of limited resources, when a

Q124: Please refer to the following data about

Q125: Please refer to the following data about

Q128: Farragut Company is evaluating an opportunity to

Q132: When a company is evaluating an investment

Q133: Which of the following would be the

Q134: Which of the following most accurately describes

Q139: Which of the following best describes capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents