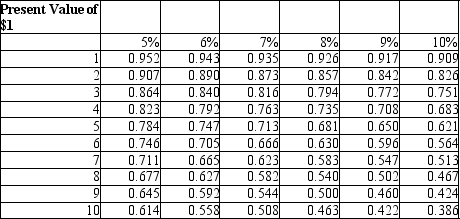

Farragut Company is evaluating an opportunity to invest $45,000 in new manufacturing equipment. It will have a useful life of 3 years, and will generate $20,000 cash flows at the end of Year 1, $30,000 of cash flows at the end of Year 2, and $10,000 of cash flows at the end of Year 3. If Farragut uses a discount rate of 5%, what is the NPV of the project?

A) $944 negative

B) $1,008 positive

C) $4,100 positive

D) $9,890 positive

Correct Answer:

Verified

Q123: Harvard Investments is considering an opportunity which

Q123: Under conditions of limited resources, when a

Q124: Please refer to the following data about

Q125: Please refer to the following data about

Q126: Beta Company is considering an investment in

Q132: When a company is evaluating an investment

Q132: Please review the information on 4 potential

Q133: Which of the following would be the

Q134: Which of the following most accurately describes

Q136: When comparing several investments with the same

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents