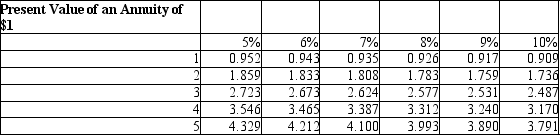

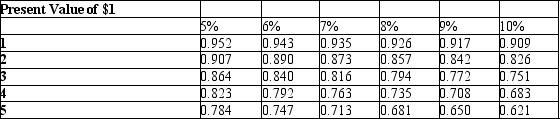

Marsh Products is evaluating an investment in new production machinery. The initial investment is $250,000 and will yield cash flows of $60,000 per year for a 5 year period. At the end of 5 years, the machinery will be sold and has expected residual value of $40,000. Marsh uses a discount rate of 7%. What is the net present value of the investment?

A) $13,460

B) $90,000

C) $2,990

D) $24,520

Correct Answer:

Verified

Q143: Quasar Company is evaluating an investment that

Q145: Which of the following best describes the

Q145: MacNamara Development Company is evaluating a possible

Q146: Osterwitz Company is evaluating an investment of

Q147: Which of the following best describes the

Q148: Petrus Company is looking at an energy-saving

Q150: Which of the following is the rate

Q151: Which of the following best describes the

Q151: Please refer to the following data concerning

Q152: Cantrell Company is considering investing $396,000 in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents