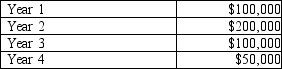

Cantrell Company is considering investing $396,000 in high-tech communications equipment which would have an estimated life of 4 years and zero residual value. The technology manager says that it will return cash flows as shown below:  The VP Finance points out that the project must pass the company's 7% hurdle rate, and asks one of the analysts to calculate the internal rate of return before they discuss the project further. Using the tables below, please calculate the IRR for this project.

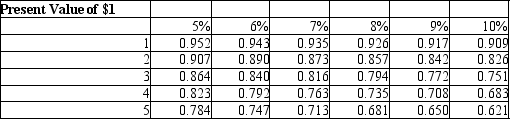

The VP Finance points out that the project must pass the company's 7% hurdle rate, and asks one of the analysts to calculate the internal rate of return before they discuss the project further. Using the tables below, please calculate the IRR for this project. Please choose the percentage below that comes closest to the actual IRR.

Please choose the percentage below that comes closest to the actual IRR.

A) 5%

B) 6%

C) 7%

D) 8%

Correct Answer:

Verified

Q143: Quasar Company is evaluating an investment that

Q145: Which of the following best describes the

Q145: MacNamara Development Company is evaluating a possible

Q146: Osterwitz Company is evaluating an investment of

Q147: Which of the following best describes the

Q148: Petrus Company is looking at an energy-saving

Q149: Marsh Products is evaluating an investment in

Q150: Which of the following is the rate

Q151: Please refer to the following data concerning

Q151: Which of the following best describes the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents