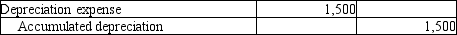

On December 31, 2012, the adjusting entry for depreciation was made incorrectly. The following is the entry which was made erroneously:  The correct amount of depreciation should have been $5,100. Consider the effects of this error on the balance sheet, and identify which of the following statements is TRUE.

The correct amount of depreciation should have been $5,100. Consider the effects of this error on the balance sheet, and identify which of the following statements is TRUE.

A) Total liabilities are overstated by $3,600.

B) Total liabilities are understated by $3,600.

C) Total assets are overstated by $3,600.

D) Total assets are understated by $3,600.

Correct Answer:

Verified

Q81: On August 1,2011,Xcel Auto Repair paid $6,000

Q82: The Accumulated depreciation account is:

A) a record

Q86: In accounting,depreciation is the:

A) method of spreading

Q89: The adjusting entry to record Depreciation expense

Q93: On December 31, 2012, the adjusting entry

Q94: Classic Artists' Services has hired a maintenance

Q95: A business pays its insurance premium of

Q96: On September 1,2011,Joy Company paid $4,000 in

Q98: Smith Technical Services is working on a

Q100: Active Education sells tickets in advance for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents