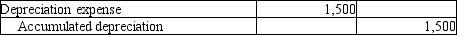

On December 31, 2012, the adjusting entry for depreciation was made incorrectly. The following entry was made erroneously:  The correct amount of depreciation should have been $5,100. Consider the effects of this error on the income statement, and identify which of the following statements is TRUE.

The correct amount of depreciation should have been $5,100. Consider the effects of this error on the income statement, and identify which of the following statements is TRUE.

A) Net income is overstated by $3,600.

B) Net income is understated by $3,600.

C) Net income is understated y $1,500.

D) Net income is not affected by this error.

Correct Answer:

Verified

Q81: On August 1,2011,Xcel Auto Repair paid $6,000

Q84: ABC Company signed a one-year $12,000 note

Q86: In accounting,depreciation is the:

A) method of spreading

Q87: Entries that record cash paid out before

Q88: ABC Company signed a one-year $12,000 note

Q89: On December 31, 2012, the adjusting entry

Q92: On January 1,2012,Lexmark Company's Accounts receivable account

Q94: Classic Artists' Services has hired a maintenance

Q95: A business pays its insurance premium of

Q96: On September 1,2011,Joy Company paid $4,000 in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents