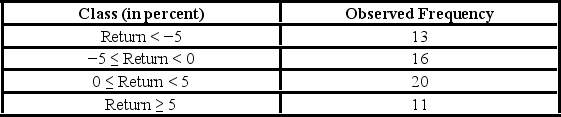

The following frequency distribution shows the monthly stock returns for Home Depot for the years 2003 through 2007.  Over the time period, the following summary statistics are provided: Mean = 0.31%, Standard deviation = 6.49%, Skewness = 0.15, and Kurtosis = 0.38. For the goodness-of-fit test for normality, the null and alternative hypothesis are ________.

Over the time period, the following summary statistics are provided: Mean = 0.31%, Standard deviation = 6.49%, Skewness = 0.15, and Kurtosis = 0.38. For the goodness-of-fit test for normality, the null and alternative hypothesis are ________.

A) H0: The returns follow a normal distribution with mean 6.49% and standard deviation 0.31%; HA: The returns do not follow a normal distribution with mean 6.49% and standard deviation 0.31%

B) H0: The returns do not follow a normal distribution with mean 6.49% and standard deviation 0.31%; HA: The returns follow a normal distribution with mean 6.49% and standard deviation 0.31%

C) H0: The returns follow a normal distribution with mean 0.31% and standard deviation 6.49%; HA: The returns do not follow a normal distribution with mean 0.31% and standard deviation 6.49%

D) H0: The returns do not follow a normal distribution with mean 0.31% and standard deviation 6.49%; HA: The returns follow a normal distribution with mean 0.31% and standard deviation 6.49%

Correct Answer:

Verified

Q104: Suppose Bank of America would like to

Q105: The following table shows the cross-classification of

Q106: The following frequency distribution shows the monthly

Q107: The following frequency distribution shows the monthly

Q108: A researcher wants to determine if the

Q110: Suppose Bank of America would like to

Q111: The following frequency distribution shows the monthly

Q112: The following table shows the observed frequencies

Q113: A researcher wants to verify his belief

Q114: Suppose Bank of America would like to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents